In stock market trading, it is customary to refer to the trading session before the close as the "tail market". Because the closing price has an indicator significance and affects the opening trend of the next day, and the trading in the late market is relatively light and the time period is short, the amount of capital required to affect the stock price is small. Therefore, the late market manipulation has become one of the common market manipulation methods. This type of manipulation is highly deceptive and confusing. Investors who do not know the truth are easily attracted by the rapid rising stock price trend in late trading, and mistakenly believe that the stock has strong rising expectations, so they blindly chase the high, but they don’t know that it is right in the middle. the manipulator's trap.

Ren so-and-so is accustomed to such methods. Ren Moumou has been engaged in block trading activities for a long time. The business model is to buy stocks reduced by shareholders of listed companies at a discount through block trading, and quickly sell them in the secondary market to realize the difference to earn the price difference. In order to achieve high-priced shipments in the secondary market, Ren Moumou repeatedly raised the closing price at the end of the market the day before the reduction, and reduced the holdings at a high price the next day. Take for example the "X" he manipulated on November 23-24, 2011:

On November 23, 2011, Ren Moumou bought 450,000 shares of "X" through a block transaction, the transaction price was 28.32 yuan, and the purchase amount was 12,744,000 yuan, and the position was completed.

November 23, 2011, near the closing period (14:56:24 to 14:59:28), in order to raise the stock price in a short period of time, Ren XX made a large number of orders to buy "X" in 4 transactions totaling 63,000 Shares, accounting for 75.54% of the market purchase volume in the late market stage; the entrusted price rose from 29.60 yuan to 32.00 yuan, each of which was higher than the buying price in the market at that time, and the stock price was raised from 29.35 yuan to 3 minutes. It closed at 30 yuan, up 2.21%. (see image below)

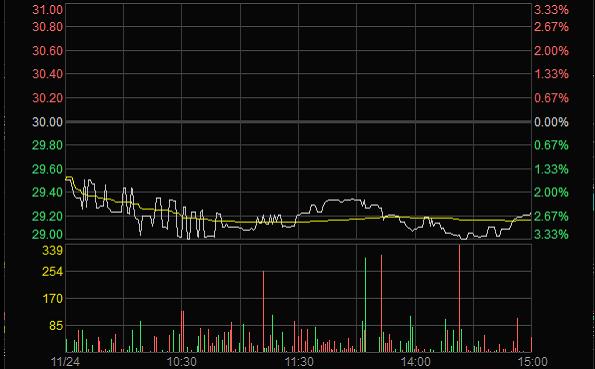

On November 24, 2011, after achieving the goal of manipulating the stock price, Ren Moumou sold all the 500,000 shares of "X" he held, causing the stock price to fluctuate and fall on that day. Ren Moumou earned nearly 300,000 yuan through Oichi's three-minute manipulation. (see image below)

In fact, even if a normal investor is optimistic about the investment value of a certain stock, it is still a legal act even if he buys it during the end of the market. The illegality of Ren Moumou’s behavior is that he bought a large number of stocks in order to raise the closing price and lure investors to follow suit. Once the target succeeds, he immediately takes the opportunity to cash out, which is not the real purpose of the transaction at all. Such behavior violates Article 77 of the Securities Law, which prohibits manipulating the securities market by other means. From 2011 to 2014, the China Securities Regulatory Commission punished him twice and issued a fine of more than 300 million yuan.

When investing in the market, investors should follow a rational investment method that conforms to the law of value, conduct calm analysis based on the situation of the market, industry and company, and be wary of market manipulators making waves and creating false prosperity. If you blindly follow the trend and hype, it is very easy to be used by market manipulators and cause heavy losses. Taking this case as an example, suppose that investor Xiao Ming was tempted by the rapid rise in the stock price in the late market, and bought at the closing price of 30 yuan, and he lost 3% the next day. I would like to remind investors that inexplicable stock price changes occurred during the end of the market, and there may be something strange. Following the trend and hyping up and chasing up and down is really licking blood. Be careful that the "pie" that falls from the sky becomes a "trap" for market manipulators ”, becoming a high-level receiver of market manipulators.